3/6/2018 By John F. O’Donnell

Don’t hold your breath for any sort of gun control reform or DACA solutions coming out of congress this week, because the Senate, instead, is working in a bipartisan capacity to rollback financial regulations on the big banks; something NO AMERICANS ARE ASKING FOR. There’s currently a bill in the Senate called the “Economic Growth, Regulatory Relief, and Consumer Protection Act,” which, of course, sounds positive, but it’s not. Wall Street watchdogs like Elizabeth Warren have renamed it the “The Bank Lobbyist Act.” Among other things, this legislation would provide deregulation for 25 of the largest financial institutions in the country, eliminate important consumer protections put into place post-2008 financial crisis, and make it harder to fight against racial discrimination by the big banks.

Sadly, this bill looks like it’s going to pass because, in addition to the ubiquitous support of GOP senators, it has the crucial co-sponsor support of 12 Democrats. In fact, according to the Center for Responsive Politics, three of the Democrats who are co-sponsoring this awful bill are also the top three overall recipients of campaign contributions from the commercial banks this election cycle.

>>We can’t do reporting like this without your help. Please become a sustaining member for as low as $5 a month. <<

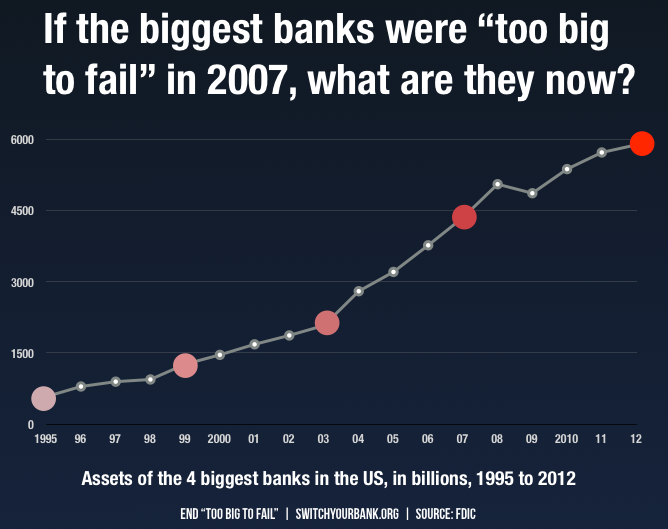

The pretense for why this bill is good for the American people is the claim that it is helping smaller community banks that are “drowning” in Dodd-Frank regulations. There’s two problems with this line of reasoning: First, it’s simply not true. And second, the parameters of this legislation are not actually limited to community banks. It rolls back regulations on huge banks with massive amounts of assets. Community banks are generally defined by having $10 billion or less in assets. This bill provides regulatory rollbacks to banks with up to $250 BILLION in assets. In fact, there’s only 12 banks that exist in our country that supersede this vast asset threshold – including of course Bank of America, Citibank, and Wells Fargo. So effectively, this legislation would take a number of large banks that contributed to the 2008 financial crisis OFF of the “watch list.” These banks would be exempt from additional oversight by regulators. They would be subject to fewer “stress tests” and lower capital reserve requirements, which allows for riskier investment on the bank’s part. And when that risky investment goes wrong, the American taxpayers are expected to be there for a massive bailout, because as we all know, these banks are too big to fail.

The only chance for this bill to be stopped is for the grassroots to apply enough pressure on lawmakers to get them to withdraw their support. And there already is a movement working to do this. Last week advocacy groups, including Rootstrikers, Public Citizen, and CREDO, presented 450,000 petition signatures to members of Congress calling for the rejection of this dangerous deregulation bill. And the activist group, Indivisible, has been calling on its members to reach out to Senate offices. Chad Bolt, the senior policy manager with Indivisible, stated, “Most [supporters] are saying this is about helping the community banks in my state. I would respond, then pass a bill that’s limited to helping community banks!” Makes sense.

You can find all the co-sponsors of the bill here, including the 12 Democrats who may be slightly more pliable in changing their opinion. Reach out to these lawmakers however you can. We don’t want a repeat of the financial crisis of 2008, and passage of this law would be a huge step in that dangerous direction.

(Our reporting is being SUPPRESSED by Facebook, Google, and YouTube. But we keep fighting thanks to heroes like you becoming sustaining members for as low as $5 a month – the same cost as a bag of movie popcorn. One bag of popcorn per month. You can also give one-time donations or sign up for the free email newsletter in the sidebar to the right. )

I still receive email from Elizabeth Warren. Though I often disagree with her positions and alliances, at least I get to know what is on her mind, in order to act upon it when such action is appropriate, in either a positive or negative response to her position. My stance regarding Warren is related to the axiom that states, ‘keep your friends close and your enemies closer.’

I did receive the email in question. However, according to Warren, it is more than 12 Democrats – 16, plus one Independent. So, perhaps some have reconsidered, based on the political impact on them and have withdrawn their support of this bill. The only ones it benefits are the oligarchic individuals and institutions.

Make lobbying illegal, or force them to call it bribery! Which is, of course, illegal!

The next war, we maybe can do something different. When the war profiteers set up the chess board, the chess pieces from both sides need to join forces, and go after the big hands that’re fucking with us.

After the $6 trillion bailout in 2008 with ZERO indictments,let alone trials (nor any convictions) for the banksters; no regulators lost their jobs nor were any of members of Congress sent to pasture. Much of the bailout $ were used for mega bonuses for banksters. Obama told us all that he would not look back but wanted to look forward-i.e. put the DOJ to sleep. This has incentivized those plutocrats to do more of the same-taxpayer bailouts will be there for them again. Face it-we are economic pawns for the power elite. Let’s collectively kiss our butts goodbye.

It seems that ALL the criminal bankers worked in Iceland. Who would have thunk dat? A world wide financial crisis caused by bankers and the only ones who went to jail are the 50 or so Icelandic bankers.

Darned Icelandic bankers. Just can’t trust them. They got busted. Everyone else in the world has incorruptible, honest bankers. Glad I live in a country where our bankers didn’t go to jail because that means they are honest.

/sarc